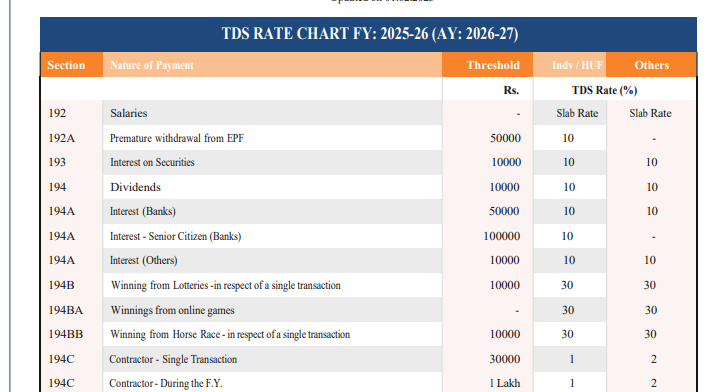

The following are the popular TDS rates applicable with effect from FY 2025-26:

| Section | Nature of Transaction | Threshold Limit (Rs) | TDS Rate (%) |

| 192 | Salary | Basic exemption limit of employee | Slab rates |

| 192A | Premature withdrawal from EPF | Rs. 50,000 | 10% |

| 193 | Interest on Securities | Rs. 10,000 | 10% |

| 194 | Dividends | Rs. 10,000 | 10% |

| 194A | on bank/post office deposits | Rs. 50,000 | 10% |

| Interest on bank/post office deposits (Senior Citizen) | Rs. 1,00,000 | 10% | |

| Interest (Others) | Rs. 10,000 | 10% | |

| 194K | Payment of dividend by mutual Funds | Rs. 10,000 | 10% |

| 194B | Lottery, game shows, gambling winnings | Rs. 10,000 | 30% |

| 194BA | Online gaming winnings | – | 30% |

| 194BB | Winnings from horse races | Rs. 10,000 (Aggregate winnings during a financial year not single transaction) | 30% |

| 194C | Payment to contractors or sub-contractors | Rs. 30,000 (Single Transaction) or Rs. 1 lakh (In a FY) | 1% for individuals and HUF, 2% for others |

| 194D | Insurance Commission | Rs. 20,000 | 2% for individuals and HUF, 10% for others |

| 194DA | Payment received – Life insurance Policy | Rs. 1 lakh | 2% |

| 194EE | Payment received – National Savings Scheme (NSS) | Rs. 2,500 | 10% |

| 194G | Lottery Commission | Rs. 20,000 | 2% |

| 194H | Commission/Brokerage | Rs. 20,000 | 2% |

| 194J(a) | Fees – Technical Services, Call Centre, Royalty, Distribution / Exhibition of Cinematography Films, etc. | Rs. 50,000 | 2% |

| 194J(b) | Fees – All other Professional Services | Rs. 50,000 | 10% |

| 194I(a) | Rent for Plant & Machinery | Rs. 50,000 | 2% |

| 194I(b) | Rent of Land Building & Furniture | Rs. 50,000 | 10% |

| 194IA | Transfer of certain immovable property other than agricultural land | Rs. 50 lakh | 1% |

| 194IB | Rent payment by individual / HUF not covered u/s 194I | Rs. 50,000 pm | 2% |

| 194IC | Payment under specified Joint Development Agreement | – | 10% |

| 194LA | Compensation on transfer of certain immovable property other than agricultural land | Rs. 5 lakh | 10% |

| 194LB | Income by way of interest from infrastructure debt fund (non-resident) | – | 5% |

| 194LBA | Certain income from units of a business trust | – | 10% |

| 194LBB | Income in respect of investment of investment fund | – | 10% for residents, 30% for non-residents, 40% for foreign companies |

| 194LBC | Income in respect of investment in securitization trust | – | 10% for residents, 40% for non-residents, 10% for individual & HUF |

| 194M | Payment made for Contracts, Brokerage or Professional Fees etc. by Individual and HUF | Rs. 50 lakh | 2% |

| 194N | Cash withdrawal in excess of 1 crore during the previous year from 1 or more account with a bank or co-operative society | 1 Crore (Rs. 3 Crores, if withdrawal is by co-operative society) | 2% |

| 20 Lakh (if ITR not filed for previous 3 years) | 2% (Rs. 20 Lakh – 1 Crore) | ||

| 5% (Rs. 1 Crore and above) | |||

| 194O | TDS on e-commerce participants | Rs. 5 lakh | 0.10% |

| 194P | TDS in case of Specified Senior Citizen (above 75 years) having Salary & Interest (ITR not required) | – | Slab Rates |

| 194Q | TDS on Purchase of Goods exceeding Rs. 50 Lakh | Rs. 50 lakh | 0.10% |

| 194R | Benefits or perquisites of business or profession | Rs. 20,000 | 10% |

| 194S | Payment of consideration for transfer of virtual digital asset by persons other than specified person | Rs. 10,000 | 1% |

| Payment of consideration for transfer of virtual digital asset by specified person | Rs. 50,000 | 1% | |

| 194T | Payments by Partnership Firms to Partners | Rs. 20,000 | 10% |

| 194B | Income by way of lottery winnings, card games, crossword puzzles, and other games of any type (Up to Rs.10,000 per transaction- No TDS needs to be deducted) | Nil | 30% |

| 194E | Payment to non-resident sportsman (including an athlete) or an entertainer (not a citizen of India) or non-resident sports association. | Nil | 20% |

| 194LBA(3) | Interest income received or receivable to a business trust from SPV and distribution to its unitholders. | Nil | 5% |

| Dividend income received from SPV by a business trust, in which it holds the entire share capital other than required to be held by the government or government body, and distribution to its unitholders. | Nil | 10% | |

| Payment in the nature of income in the nature of rental income, out of real estate assets owned directly by such business trust, to unitholders. | Nil | 40% | |

| 194LC | Payment in the nature of interest for the loan borrowed in foreign currency by an Indian company or business trust against loan agreement or against the issue of long-term bonds*. | Nil | 5% |

| If interest is payable against long term bonds listed in recognized stock exchange in IFSC | Nil | 4% | |

| 194LD | Payment of interest on the bond (rupee-denominated) to Foreign Institutional Investors or a Qualified Foreign Investor | Nil | 5% |

| 195 | Payment of any other sum, such as-Income by way of LTCG under section 112(1)(c)(iii); | Nil | 12.50% |

| Income by way of LTCG under section 112A; | Nil | 12.50% | |

| Income by way of STCG under section 111A; | Nil | 20% | |

| Any other income by way of LTCG; | Nil | 12.50% | |

| Interest payable on money borrowed by the government or Indian concern in foreign currency; | Nil | 20% | |

| Income by way of royalty | Nil | 20% | |

| Income from technical fees to the Indian concern by government or Indian concern in pursuance of an agreement on matters related to industrial policy. | Nil | 20% | |

| Any other income. | Nil | 35% | |

| 196B | Income from units of an offshore fund. | Nil | 10% |

| Long-term Capital Gain on transfer of units an offshore fund. | Nil | 12.50% | |

| 196C | Income from foreign currency bonds or GDR of an Indian company | Nil | 10% |

| LTCG foreign currency bonds or GDR of an Indian company | Nil | 12.50% | |

| 196D | Income (excluding dividend and capital gain) from Foreign Institutional Investors. | Nil | 20% |

TDS Rate Changes FY 2025-26

The following are the changes made in TDS provisions with effect from 1st April, 2025.

- The government has changed threshold limit for TDS deduction for various sections. The relaxed threshold limits are as follows

| Section | Previous Threshold Limits | Modified Threshold Limits |

| 193 – Interest on securities | NIL | 10,000 |

| 194A – Interest other than Interest on securities | (i) 50,000/- for senior citizen; (ii) 40,000/- in case of others when payer is bank, cooperative society and post office (iii) 5,000/- in other cases | (i) 1,00,000/- for senior citizen (ii) 50,000/- in case of others when payer is bank, cooperative society and post office (iii) 10,000/- in other cases |

| 194 – Dividend, for an individual shareholder | 5,000 | 10,000 |

| 194K – Income in respect of units of a mutual fund | 5,000 | 10,000 |

| 194B – Winnings from lottery, crossword puzzle Etc. & 194BB – Winnings from horse race | Aggregate of amounts exceeding 10,000/- during the financial year | 10,000/- in respect of a single transaction |

| 194D – Insurance commission | 15,000 | 20,000 |

| 194G – Income by way of commission, prize etc. on lottery tickets | 15,000 | 20,000 |

| 194H – Commission or brokerage | 15,000 | 20,000 |

| 194-I – Rent | 2,40,000 (in a financial year) | 6,00,000 (in a financial year) |

| 194J – Fee for professional or technical services | 30,000 | 50,000 |

| 194LA – Income by way of enhanced compensation | 2,50,000 | 5,00,000 |

| 206C(1G) – Remittance under LRS and overseas tour program package | 7,00,000 | 10,00,000 |

- Section 206AB which added compliance burden for TDS deductors has been removed.

- The TDS rate for section 194LBC – Income received from investment in securitization trusts for residents has been reduced to 10%.

- With effect from 1st April, 2025, a new section 194T is inserted, wherein TDS has to be deducted on partner’s remuneration at 10%.

Frequently Asked Questions

What to do if there is any mistake in deduction of Tax at Source (TDS)?

If TDS is shortly deducted erroneously, then the balance tax should immediately be deposited vide a new challan. If excess TDS is deducted and deposited, the excess amount paid can be used for other TDS payments, after rectification of TDS challan.

Where can we check the amount of TDS credit available?

The amount of TDS credit can be checked under Form 26AS.

What are the key changes in TDS rates effective from April 2025?

TDS rates under section 194LBC – income from investments in securitization trust is changed from FY 2025-26. The TDS rate when the payee is a resident is 10%, regardless of whether the assessee is an individual, HUF, or any other entity. Previously, it was 25% when the payee is an individual or HUF, 30% for other entities.

What is interest rate for late payment of TDS?

When TDS is appropriately deducted but not paid to the government within specified due dates, late onterest at the rate of 1.5% per month needs to be paid. It is to be paid from the due date for TDS payment and the date in which TDS is actually paid to government.

What is the interest rate for late deduction of TDS?

Interest at the rate of 1% per month needs to be paid if the TDS is not deducted on time. Interest to be paid from the date in which TDS should be deducted to the date in which it is actually deducted.

When should we deduct TDS at higher rate?

When PAN is not duly furnished by the payee, a higher rate of TDS needs to be deducted. Deduction should be made at 20%. If the higher TDS rate for non furnishing of PAN is specifically mentioned in the section, rate as mentioned in that section should be considered.

What is the TDS rate for professional fees?

10% is the rate of TDS for professional services. In case of technical services 2% TDS needs to be deducted.

What is the rate of TDS for casual income?

30% TDS needs to be deducted for casual income.

What is the TDS rate for commission?

2% of TDS needs to be deducted for commission. If the commission is paid to a director as a part of his remuneration, 10% needs to be deducted u/s 194J.

What is the TDS rate for NRI?

When the amount is paid to an NRI, TDS rates is specifically mentioned for certain kinds of payments. TDS needs to be deducted u/s 195 if the nature of payment is not specifically covered under any TDS rates. Also, cess needs to be deducted in addition to TDS on making payment to NRI.

Madhuban post malikpura , birno Gazipur

MD dildhad

Madhuban,malikpura, birno , Gazipur

EAFPR0665P

Raja

akk209402@gmail.com

sr9209312316@gmail.com

Obvesse

Kotresha

Good

Vimlesh Kumar Pandit

Meri iti ki iscolar kab dalegi 2025 1 ihyar ki

Meri kab daloge

Imran sain